UYG has been generating substantial gains for shareholders in recent months. The company's stellar performance can be attributed to a number of factors, including its {strategic investments, its commitment to innovation, and the growing market they operates in.

- UYG's recent financial reports reveal a positive trajectory, with income surpassing analysts' predictions.

- Furthermore, the company has been proactively developing its customer base, which contributes its overall growth.

- In spite of the headwinds facing the broader market, UYG remains a dependable investment proposition.

The ProShares Ultra Financials ETF (UYG): Double Down on Financial Sector Gains, Brace for Increased Uncertainty

The ProShares Ultra Financials ETF (UYG) is a leveraged fund designed to provide investors with amplified exposure to the performance of the financials industry. By employing a magnified approach, UYG aims to harness the upswings within the financial industry, but it also comes with a significant increase in risk. While UYG can {potentially delivertremendous profits during bull cycles, downturns can result in dramatic declines. It's essential for traders to carefully consider the inherent risks associated with leveraged ETFs before putting money in.

- Factors to Consider Before Investing in UYG: Market Volatility, Financial Sector Performance, Risk Tolerance, Investment Goals

Leveraged Financial Gains: Methods for Trading UYG

Navigating the volatile world of leveraged trading necessitates a keen understanding of risk management and strategic execution. Should venturing into this arena, particularly with assets like UYG, which are known for their price fluctuations, meticulous planning is paramount. Utilizing leverage can amplify both gains, but it also magnifies potential losses. Therefore, traders must utilize robust risk mitigation strategies to safeguard their capital.

- Quantitative analysis can provide valuable insights into UYG's underlying value and probability of price movements.

- Portfolio Allocation across various asset classes can help mitigate overall risk exposure.

- Limit orders are essential tools for automatically controlling potential losses when prices move against your position.

,Moreover, staying informed about industry news that shape UYG's price can give traders a competitive edge.

UYG ETF Analysis: Unpacking the Performance of a 2x Financials Play

The ProShares Ultra Financials ETF (UYG) has recently been generating {considerableattention amongst investors due UYG performance during bull markets to its unique tactic of amplifying returns in the financial sector. This report aims to {delveexplore the performance of UYG, providing a comprehensive analysis of its recent trends.

By examining drivers such as marketdynamics and sectorspecificnews, we can {gainshed light on the potentialrisks associated with this amplified ETF.

For investors considering adding UYG to their portfolios, a thorough understanding of its {strengthsand weaknesses) is essential.

Exploiting Financial Leverage: The Pros and Cons of Trading UYG

Trading UYG presents a unique scenario to leverage your finances and potentially amplify your returns. This derivative allows investors to wager on the movement of underlying securities. Conversely, UYG trading also comes with inherent volatility that require careful consideration.

- Potential for high returns

- Leverage effect can magnify gains

- Access to diverse market opportunities

Acknowledging the potential benefits, UYG trading is not without its drawbacks.

- Significant risk of losses

- High leverage can exacerbate losses

- Complex trading strategies may be required

Before embarking on a UYG trading journey, it's essential to conduct thorough research, understand the risks involved, and develop a well-defined trading plan. Note that UYG trading is not suitable for all investors.

Exploring Leveraged Finance

Is leveraged financials trading suitable for you? It's a intricate world, offering the potential for substantial returns but also carrying inherent vulnerability. This guide will shed light on the aspects of leveraged financials trading, helping you determine if it's the proper fit for your trading strategy.

- Initially, let's explore what leveraged financials trading actually entails.

- Subsequently, we'll delve into the possible benefits and drawbacks associated with this type of trading.

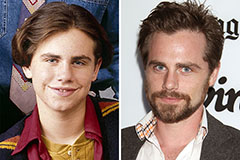

Rider Strong Then & Now!

Rider Strong Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now!